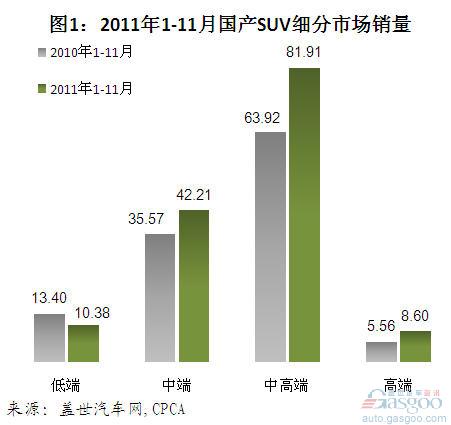

First, the SUV market structure changes SUV sales growth: the highest growth in the high-end market, low-end market sales decline According to Gasgoo.com, the sales of China-made SUVs increased by 20.8% to 143.10 in January-November 2011. 10,000 cars. According to the price, the domestic SUV market will be divided into four major market segments (see the notes for specific model classifications): Low-end (80,000 yuan or less), Mid-range (8-15 million yuan), High-end (15-30 million yuan) And high-end (more than 300,000 yuan), the fastest growth in sales from January to November this year is the high-end market, its sales increased 54.7% to 8600; mid-end and mid-high-end market sales rose 18.6% and 28.1% to 421,100 There were 8.1,110,000 vehicles and sales in the low-end market fell from 134,000 units in the same period last year to 103,800.

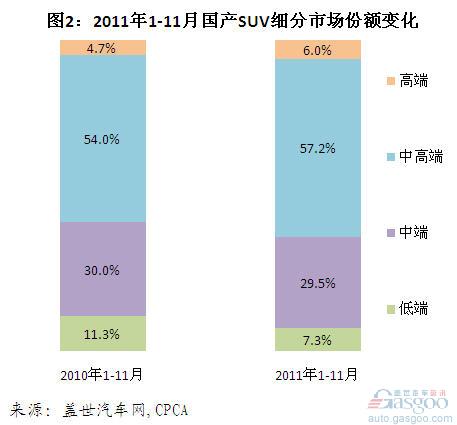

SUV Market Share: The Highest and Middle-End Markets Have Raised The Highest Drop in the Low-end Market The market share of the high-end and high-end SUVs has increased. Among them, the market share increased the most in the high-end market - from 54.0% in the same period last year to 57.2%; followed by high-end market - market share increased by 1.3 percentage points to 6.0%.

The market share in the mid-range and low-end has declined. Among them, the low-end market share contracted the fastest, from 11.3% in the same period last year to 7.3%; the mid-market share decreased slightly by 0.5% to 29.5%.

II. Changes in the share of major automakers in the four major market segments From the perspective of corporate distribution, foreign-funded enterprises are all concentrated in mid-to-high-end and high-end markets, while autonomous automakers are mainly concentrated in mid- and low-end markets, but at the same time Some models entered the high-end market. The following is a detailed analysis of the business distribution and market share of major market segments.

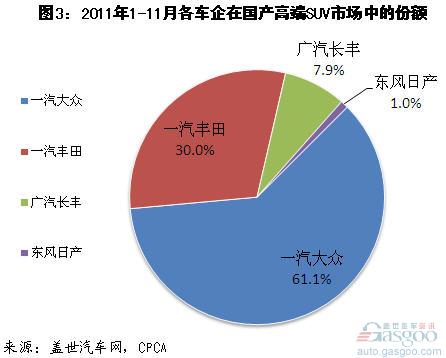

High-end market: Audi Q5 market share over 60%

The domestic high-end SUV market has been divided by foreign companies FAW-Volkswagen, GAC Changfeng, Dongfeng Nissan and FAW Toyota. Among them, FAW-Volkswagen domestic Audi Q5 sales from January to November this year, an increase of 80.9% to 52,500 vehicles, accounting for 61.1% of the domestic high-end SUV market, accounting for the highest proportion. Followed by Prado and Land Cruiser of FAW Toyota Motor, the total sales volume was 25,800 units, accounting for 30.0%. The third-largest sales volume is GAC Changfeng Pajero, which sold 6,286 cars in January-November this year, accounting for 7.9%. Dongfeng Nissan entered the high-end SUV market this year. In September this year, its high-end SUV Loulan was listed but its sales volume was not good. In November, it was only 829 units, accounting for 1.0%.

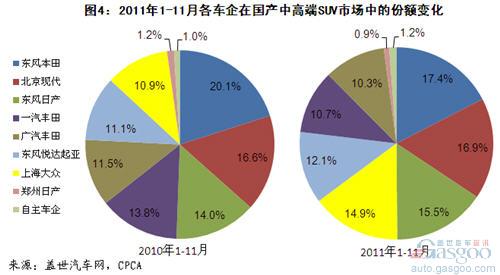

Middle-end and high-end: The self-owned brand accounts for only 1% of the mid- to high-end SUV market. Independent brands continue to explore the market, but the competitiveness is far weaker than that of foreign brands, which only account for 1% of the market. As of November this year, the independent brands that have entered the market include Shanghai Automotive, Dongfeng Yulon, Huatai Automobile and Beijing Automobile. Among them, Beijing Automotive has already entered the market, but the market performance is not good, from January to November this year, down 40.5% to 3,808 vehicles. Shanghai Automotive, Dongfeng Yulon and Huatai Motor have all launched new cars this year – Roewe W5, Nasit Seven 7SUV and Huatai B35. They have entered the market, and their accumulated sales were 3,285, 2,969 and 122 vehicles respectively in November.

The other 99% of the market share is occupied by Dongfeng Honda, Beijing Hyundai, Dongfeng Nissan, FAW Toyota, GAC Toyota, Dongfeng Yueda Kia, Shanghai Volkswagen and Zhengzhou Nissan's domestic SUVs. Of these companies, Dongfeng Honda, FAW Toyota, GAC Toyota, and Zhengzhou Nissan have dropped their market shares. Among them, FAW Toyota has the highest decline. Its RAV4 sales slightly decreased by 0.6% to 87,500 units, and its market share decreased by 3.1%. To 10.7%. Followed by Dongfeng Honda CR-V and Guangzhou Automobile Toyota Highlander, sales volume increased by 11.3% and 15.2% to 214,600 units and 84,400 units respectively, but market share dropped by 2.7% and 1.2% to 17.4% and 10.3%, respectively. Zhengzhou Nissan Paladin sales fell 2.8% to 7,421 units, and its market share dropped to 0.9%.

The market share rises include Beijing Hyundai, Dongfeng Nissan, Shanghai Volkswagen, and Dongfeng Yueda Kia. The fastest rising is Shanghai Volkswagen, which saw Tiguan increase sales by 76.9% to 122,400 units. Its market share increased from 10.9% in the same period of last year. 14.9%, more than FAW Toyota, GAC Toyota and Dongfeng Yueda Kia, second only to Dongfeng Nissan. The second fastest increase in market share was Dongfeng Nissan. The combined sales volume of Qijun and Qiako’s sales grew by 42.2% to 121,700 units, a 1.5% increase to 15.5%. Sales of Beijing Hyundai (including ix35 and Tucson) and Dongfeng Yueda Kia (including Lion Run and Chi running) increased by 31.1%, 39.1% to 138,700, and 98,900, respectively, with their share rising slightly by 0.3% and 1.0% to 16.9% respectively. 12.1%.

Mid-range: Chery’s market share exceeds that of Huatai. It is second only to the mid-range and low-end SUVs of the Great Wall. In the mid-end SUV market, based on the data collected by Gasgoo.com, the number of companies that had a market share of over 10% in the period from January to November this year was 4 Great Wall Motors, Chery Automobile, Huatai Automobile, and BYD. Among them, the largest market share is Great Wall Motor (Haval H series SUV), which sold 123,000 vehicles this year, with a market share of 29.2%. From January to November this year, Chery’s mid-range SUVs (including Weilin X5 and Tiggo) increased 62.7% from the same period last year to 91,900 units. Its market share increased from 15.9% in the same period of last year to 21.8%, which exceeded that of Huatai Automobile and rose to second place. Sales of Huatai Auto's mid-range SUVs (including Santa Fe and Traka) fell 37.7% to 45,600 units, and its market share decreased from 20.5% in the same period last year to 10.8%. BYD listed a new car S6 this year and entered the mid-end SUV market. As of November, it had a total sales volume of 45,200 units and a market share of 10.7%, slightly lower than Huatai.

Low-end: Great Wall, Chery, and Huatai have sold 10,000 other companies, and 10,000 other low-end SUVs in the market. There are 8 independent brand companies, namely Beijing Automotive, Beiqi Foton, Great Wall Motors, Gio Auto, Lifan Motors, and Meiya Motors. Chery Automobile and Zhongtai Automobile. Among them, from January to November this year, only Great Wall Motors, Chery Automobiles, and Zotye Automobile sold more than 10,000 vehicles. The sales of low-end SUVs were 18,200, 13,300, and 65,700.

Note:

In this paper, China's domestic SUV segmentation market classification:

1, high-end (manufacturer guide price> = 300,000): Audi Q5, Prado, Pajero, Land Cruiser and Loulan.

2, high-end (15 million <= factory guide price <300,000 yuan): Beijing Lu Ba and Warriors, Hyundai ix35 and Tucson, Honda CR-V, Nissan Qijun and Hacker, Na Zhijie 7SUV, Kia Lion Run and Wisdom Run, Toyota Highlander, Huatai B35, Volkswagen Tiguan, Roewe W5, Toyota RAV4, Nissan Paladin.

3. Mid-end (80,000 yuan <= factory guide price <15, 000 yuan): Beijing Cross (other SUVs), BYD S6, Great Wall Haval H Series, Feiteng-Cheetah, Southeast Fulica, Seahorse Knights, China V5, Huatai Santa Fe and Traka, Gioault, Jianghuai Ruiying, Jiangling Baowei and Landwind SUV, Weilin X5, Chery Tiger, Dongfeng Odin, Huanghai SUV, ZTE Unlimited SUV.

4, low-end (factory guide price <8 million): Beijing 2020 series, Legend of Fukuda, Great Wall Haval M Series, Gio GS50 and Shuai ship, Lifan X60, Amelia Jones, Ruiqi M1-Jeep, Zotye 2008 and Zotye 5008 .

SUV Market Share: The Highest and Middle-End Markets Have Raised The Highest Drop in the Low-end Market The market share of the high-end and high-end SUVs has increased. Among them, the market share increased the most in the high-end market - from 54.0% in the same period last year to 57.2%; followed by high-end market - market share increased by 1.3 percentage points to 6.0%.

The market share in the mid-range and low-end has declined. Among them, the low-end market share contracted the fastest, from 11.3% in the same period last year to 7.3%; the mid-market share decreased slightly by 0.5% to 29.5%.

II. Changes in the share of major automakers in the four major market segments From the perspective of corporate distribution, foreign-funded enterprises are all concentrated in mid-to-high-end and high-end markets, while autonomous automakers are mainly concentrated in mid- and low-end markets, but at the same time Some models entered the high-end market. The following is a detailed analysis of the business distribution and market share of major market segments.

High-end market: Audi Q5 market share over 60%

The domestic high-end SUV market has been divided by foreign companies FAW-Volkswagen, GAC Changfeng, Dongfeng Nissan and FAW Toyota. Among them, FAW-Volkswagen domestic Audi Q5 sales from January to November this year, an increase of 80.9% to 52,500 vehicles, accounting for 61.1% of the domestic high-end SUV market, accounting for the highest proportion. Followed by Prado and Land Cruiser of FAW Toyota Motor, the total sales volume was 25,800 units, accounting for 30.0%. The third-largest sales volume is GAC Changfeng Pajero, which sold 6,286 cars in January-November this year, accounting for 7.9%. Dongfeng Nissan entered the high-end SUV market this year. In September this year, its high-end SUV Loulan was listed but its sales volume was not good. In November, it was only 829 units, accounting for 1.0%.

Middle-end and high-end: The self-owned brand accounts for only 1% of the mid- to high-end SUV market. Independent brands continue to explore the market, but the competitiveness is far weaker than that of foreign brands, which only account for 1% of the market. As of November this year, the independent brands that have entered the market include Shanghai Automotive, Dongfeng Yulon, Huatai Automobile and Beijing Automobile. Among them, Beijing Automotive has already entered the market, but the market performance is not good, from January to November this year, down 40.5% to 3,808 vehicles. Shanghai Automotive, Dongfeng Yulon and Huatai Motor have all launched new cars this year – Roewe W5, Nasit Seven 7SUV and Huatai B35. They have entered the market, and their accumulated sales were 3,285, 2,969 and 122 vehicles respectively in November.

The other 99% of the market share is occupied by Dongfeng Honda, Beijing Hyundai, Dongfeng Nissan, FAW Toyota, GAC Toyota, Dongfeng Yueda Kia, Shanghai Volkswagen and Zhengzhou Nissan's domestic SUVs. Of these companies, Dongfeng Honda, FAW Toyota, GAC Toyota, and Zhengzhou Nissan have dropped their market shares. Among them, FAW Toyota has the highest decline. Its RAV4 sales slightly decreased by 0.6% to 87,500 units, and its market share decreased by 3.1%. To 10.7%. Followed by Dongfeng Honda CR-V and Guangzhou Automobile Toyota Highlander, sales volume increased by 11.3% and 15.2% to 214,600 units and 84,400 units respectively, but market share dropped by 2.7% and 1.2% to 17.4% and 10.3%, respectively. Zhengzhou Nissan Paladin sales fell 2.8% to 7,421 units, and its market share dropped to 0.9%.

The market share rises include Beijing Hyundai, Dongfeng Nissan, Shanghai Volkswagen, and Dongfeng Yueda Kia. The fastest rising is Shanghai Volkswagen, which saw Tiguan increase sales by 76.9% to 122,400 units. Its market share increased from 10.9% in the same period of last year. 14.9%, more than FAW Toyota, GAC Toyota and Dongfeng Yueda Kia, second only to Dongfeng Nissan. The second fastest increase in market share was Dongfeng Nissan. The combined sales volume of Qijun and Qiako’s sales grew by 42.2% to 121,700 units, a 1.5% increase to 15.5%. Sales of Beijing Hyundai (including ix35 and Tucson) and Dongfeng Yueda Kia (including Lion Run and Chi running) increased by 31.1%, 39.1% to 138,700, and 98,900, respectively, with their share rising slightly by 0.3% and 1.0% to 16.9% respectively. 12.1%.

Mid-range: Chery’s market share exceeds that of Huatai. It is second only to the mid-range and low-end SUVs of the Great Wall. In the mid-end SUV market, based on the data collected by Gasgoo.com, the number of companies that had a market share of over 10% in the period from January to November this year was 4 Great Wall Motors, Chery Automobile, Huatai Automobile, and BYD. Among them, the largest market share is Great Wall Motor (Haval H series SUV), which sold 123,000 vehicles this year, with a market share of 29.2%. From January to November this year, Chery’s mid-range SUVs (including Weilin X5 and Tiggo) increased 62.7% from the same period last year to 91,900 units. Its market share increased from 15.9% in the same period of last year to 21.8%, which exceeded that of Huatai Automobile and rose to second place. Sales of Huatai Auto's mid-range SUVs (including Santa Fe and Traka) fell 37.7% to 45,600 units, and its market share decreased from 20.5% in the same period last year to 10.8%. BYD listed a new car S6 this year and entered the mid-end SUV market. As of November, it had a total sales volume of 45,200 units and a market share of 10.7%, slightly lower than Huatai.

Low-end: Great Wall, Chery, and Huatai have sold 10,000 other companies, and 10,000 other low-end SUVs in the market. There are 8 independent brand companies, namely Beijing Automotive, Beiqi Foton, Great Wall Motors, Gio Auto, Lifan Motors, and Meiya Motors. Chery Automobile and Zhongtai Automobile. Among them, from January to November this year, only Great Wall Motors, Chery Automobiles, and Zotye Automobile sold more than 10,000 vehicles. The sales of low-end SUVs were 18,200, 13,300, and 65,700.

Note:

In this paper, China's domestic SUV segmentation market classification:

1, high-end (manufacturer guide price> = 300,000): Audi Q5, Prado, Pajero, Land Cruiser and Loulan.

2, high-end (15 million <= factory guide price <300,000 yuan): Beijing Lu Ba and Warriors, Hyundai ix35 and Tucson, Honda CR-V, Nissan Qijun and Hacker, Na Zhijie 7SUV, Kia Lion Run and Wisdom Run, Toyota Highlander, Huatai B35, Volkswagen Tiguan, Roewe W5, Toyota RAV4, Nissan Paladin.

3. Mid-end (80,000 yuan <= factory guide price <15, 000 yuan): Beijing Cross (other SUVs), BYD S6, Great Wall Haval H Series, Feiteng-Cheetah, Southeast Fulica, Seahorse Knights, China V5, Huatai Santa Fe and Traka, Gioault, Jianghuai Ruiying, Jiangling Baowei and Landwind SUV, Weilin X5, Chery Tiger, Dongfeng Odin, Huanghai SUV, ZTE Unlimited SUV.

4, low-end (factory guide price <8 million): Beijing 2020 series, Legend of Fukuda, Great Wall Haval M Series, Gio GS50 and Shuai ship, Lifan X60, Amelia Jones, Ruiqi M1-Jeep, Zotye 2008 and Zotye 5008 .

Leak Testing Equipment,Quality Control Leak Testing,Leakage Detection Machinery

Sentis Equipment Co.,Ltd , https://www.speblowmold.com